The Asset Management Context

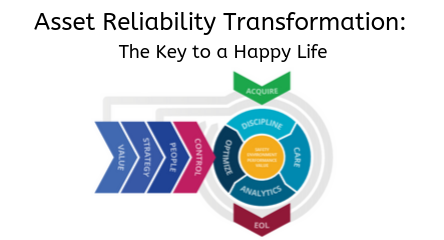

Asset management has been described by ISO 55000:2014 as the coordinated set of activities by an organization to realize value from assets. Consequently, the goal of an asset management system is to coordinate asset life cycle activities to achieve the objectives of the organization. For an organization to be successful, assets must generate both financial and non-financial value, but it is the operational use of the assets that create economic value. Therefore, asset-dependent organizations will not be successful without alignment of the various operational functions with each other and with financial functions across the asset’s life cycle. This alignment is achieved through business processes and decision-making systems to deliver the most effective business strategy for the portfolio of assets.

Alignment is crucial to the creation of sustainable economic value. From several eras of business management, we have also recognized that this cannot be purely a financially driven activity without deep understanding of the life cycle activities that roll up to the balance sheet. Asset management provides that alignment between asset acquisition activities, operational activities, disposal activities and the generation of economic value. This has positioned Board of Directors and company executives in pivotal roles. Yet, it is still quite common for Board of Directors and company executives to have unclear or misaligned understanding about asset management and their role in creating a sustainable asset management program.

C-Suite & Board Sponsorship is a Key Success Factor

As asset management programs roll out in organizations, the education of middle management and professionals has also increased in step. This has created an emerging gap, as the professionals return to their organizations all geared up and ready, only to be confronted by unsupportive, uncollaborative business cultures and processes. Given that asset management implementation is about re-orienting the organization, the most important and urgent change that is needed is to change the mindset of executives and the board. In addition to setting strategy, senior management directly controls what can be achieved in the organization through the allocation of resources, setting cultural tones and rewarding behaviors that reinforce those cultural tones. In other words, senior management directly controls how much value can be derived from the assets. Here are a few reasons why the asset management transformation cannot be driven from the bottom or middle of the organization and will fall flat without executive sponsorship:

1. The asset management transformation is exactly that, a transformation of the way that asset-dependent firms operate, it is not a project, nor is it an initiative, nor is it to be merely confined to the development of an asset management plan. Many organizations

wrote asset management plans years ago, only to declare that they were not effective, largely because no system was put in place to achieve the plans, nor were any fundamental changes made to the organizations to sustain the plan. It is a fundamental shift in the way that many organizations do business, and a sustainable approach needs to be applied over time.

2. Top management, particularly CEOs, CAOs, CFOs, and COOs, elected officials, and Boards of Directors are responsible to the stakeholders for value creation. All other levels of management have delegated responsibility, but the buck really does stop with the executives and the Board or elected officials.

3. It is the operational use of assets that create value and as such, it is also the operational use of assets that creates huge sources of financial and operational risks. The failure of a major asset presents risks such as production/operational losses, direct negative impact to cash flow to repair the asset, and impact to profitability to account for undepreciated value or any other asset retirement obligations.

4. Given that capital projects are often funded from borrowing, replacing an asset that no longer complies with environmental regulations, for example, could plunge the company into debt that it is not prepared to undertake.

5. In many of our organizations, financial information is not aligned with operational information. This is a situation that reduces financial visibility on both the business and operational sides of the business. Leaving the operational side unaware of the assets’ cost performance and risks, and the financial side unaware of how and which operational activities contribute to or leak value until it shows up on financial statements after the fact.

6. The current culture in many organizations does not facilitate an easy transformation to an asset management culture. Top management directly controls organizational resources, culture and the reward system that reinforce it. Therefore, in aligning the organization, the board and c-suite executives cannot leave middle management to navigate the cultural waters alone, that will only lead to organizational conflict.

7. Asset-intensive firms are usually structured according to areas of specialization, leading to business processes that are equally compartmentalized and inwardly focused. As departments are independently led, each department creates its own processes to manage the assets, without consultation or integration of other processes. Based on current asset management maturity, structural changes may be required to deploy an effective asset management policy and program. Middle and frontline management are not vested with the authority to arrange the organizational structure or make changes to the processes of another department.

Strategy for Executive Level Education

In addressing this growing gap, the strategy for executive-level education cannot be the same as for an asset management professionals and middle management. Executive-level education should focus on positioning the organization and its leadership to support the implementation of asset management systems. The focus should be on creating alignment of the various disciplines, activities, and processes in the organization, providing visible leadership to the asset management system, and setting the tone and expectations of the culture.